CLOB: The Future of DEX

Central Limit Order Books (CLOBs) are set to transform decentralized exchanges by bringing institutional-grade trading features on-chain. Unlike Automated Market Makers, CLOBs enable precise order placement, tighter spreads, and advanced order types while maintaining transparency and user custody. Enabled by fast blockchain technologies, decentralized CLOBs offer CEX-like speed and execution, making them ideal for professional and high-frequency traders. This evolution will create a hybrid trading ecosystem where CLOBs and AMMs together meet the diverse needs of retail and institutional users, driving decentralized finance toward mainstream adoption and bridging TradFi with DeFi.

recommended post

By Jacky Kwong

Equity Research Analyst

CLOB: The Future of DEX

Decentralized exchanges (DEXs) have revolutionized cryptocurrency trading by enabling peer-to-peer asset swaps without intermediaries. Among DEX models, Automated Market Makers (AMMs) have dominated due to their simplicity and accessibility. However, the next evolution in DEX trading infrastructure points toward Central Limit Order Books (CLOBs), which promise to bring professional-grade trading features and deeper market efficiency to on-chain trading.

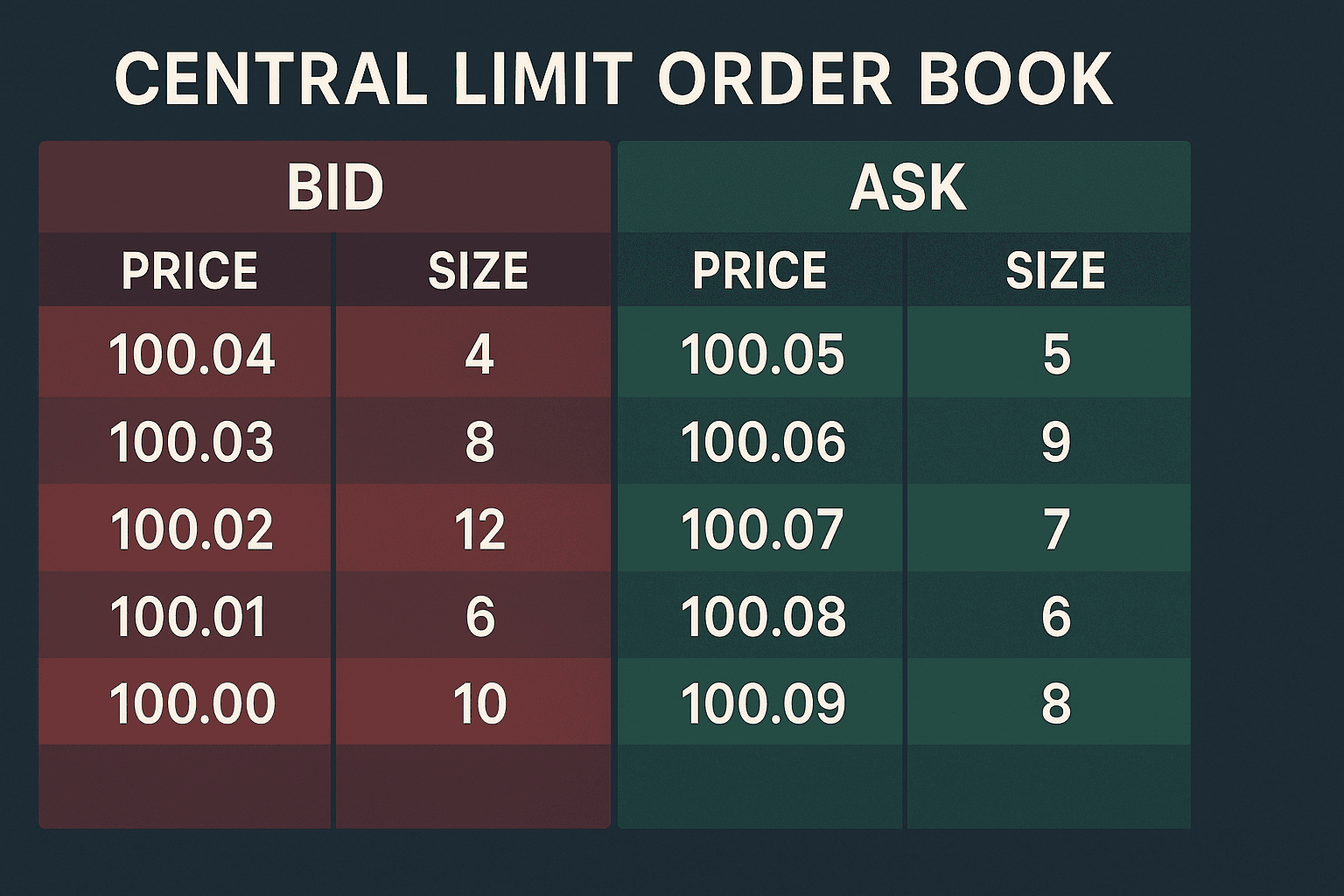

Understanding CLOB and Its Benefits in DEXs

A Central Limit Order Book is a traditional market structure where buy and sell orders are aggregated, matched, and executed based on price and time priority. Unlike AMMs that autonomously price assets using formulas, CLOBs enable traders to place limit orders at desired prices, allowing for sophisticated trading strategies, tighter spreads, and better price discovery.

For decentralized exchanges, adopting CLOBs means overcoming historical challenges of latency, cost, and blockchain finality. Thanks to advancements in Layer 1 and Layer 2 blockchain technologies — offering millisecond-level transaction speeds and single-block finality — decentralized CLOBs can now approach or match the speed and efficiency traditionally exclusive to centralized exchanges (CEXs).

Why CLOBs Are Poised to Surpass AMMs

While AMMs remain vital for providing liquidity and enabling simple swaps, CLOBs cater to institutional traders, market makers, and frequent traders who demand low latency, front-running resistance, and order control. The key advantages of decentralized CLOBs include:

CEX-Like Speed and Execution: Modular architectures leveraging ultra-fast blockchains can deliver sub-200ms block times with deterministic execution, minimizing the risks of frontrunning and ensuring fair order matching.

Order Book Transparency and User Custody: On-chain CLOBs maintain transparent order books accessible to all participants and enable non-custodial trading from personal wallets, aligning with DeFi’s ethos.

Sophisticated Order Types: CLOBs support cancellation priorities, good-till-cancel, immediate-or-cancel orders, and complex matching logic crucial for professional trading.

Bridging TradFi and DeFi: By replicating Wall Street-grade infrastructure on-chain, CLOB-based DEXs open doors for institutional adoption and enable on-chain trading of traditional securities like stocks and bonds in a decentralized environment.

Challenges and the Path Forward

Despite the promise, decentralized CLOBs face challenges such as sequencer censorship risk, requiring the development of escape hatches for users to withdraw funds securely in adversarial scenarios. Additionally, not all blockchain layers currently satisfy the stringent requirements of CLOBs for finality and latency, but ongoing innovations in rollups and custom chains are rapidly closing this gap.

Interestingly, the future of decentralized trading may not be a binary choice between AMMs and CLOBs. Instead, a hybrid ecosystem where AMMs provide liquidity and initial price discovery for niche assets, while CLOBs enable high-frequency, low-slippage trading for mainstream and institutional assets, will likely emerge.

As DeFi matures, CLOBs stand as the next wave to transform decentralized trading by delivering exchange-grade performance, transparency, and control to users. This shift will not only enhance trading experience for retail users but will also unlock institutional participation, bridging traditional finance and blockchain's decentralized future. The adoption of decentralized CLOBs marks a significant step toward realizing the full potential of a programmable and composable financial ecosystem on-chain.